foreign gift tax cpa

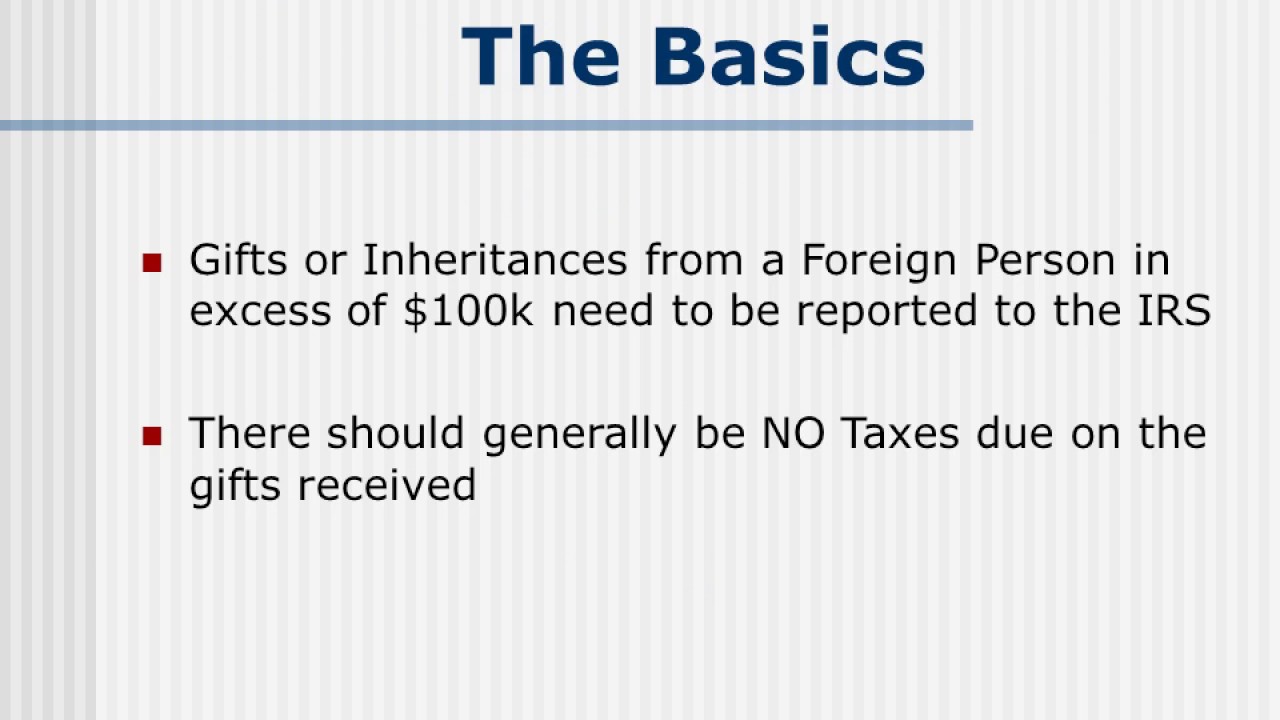

If the gift is from a nonresident alien or a foreign estate reporting is only required if the total amount of gifts from the nonresident alien or foreign estate is more than 100000 plus an. If you are a US.

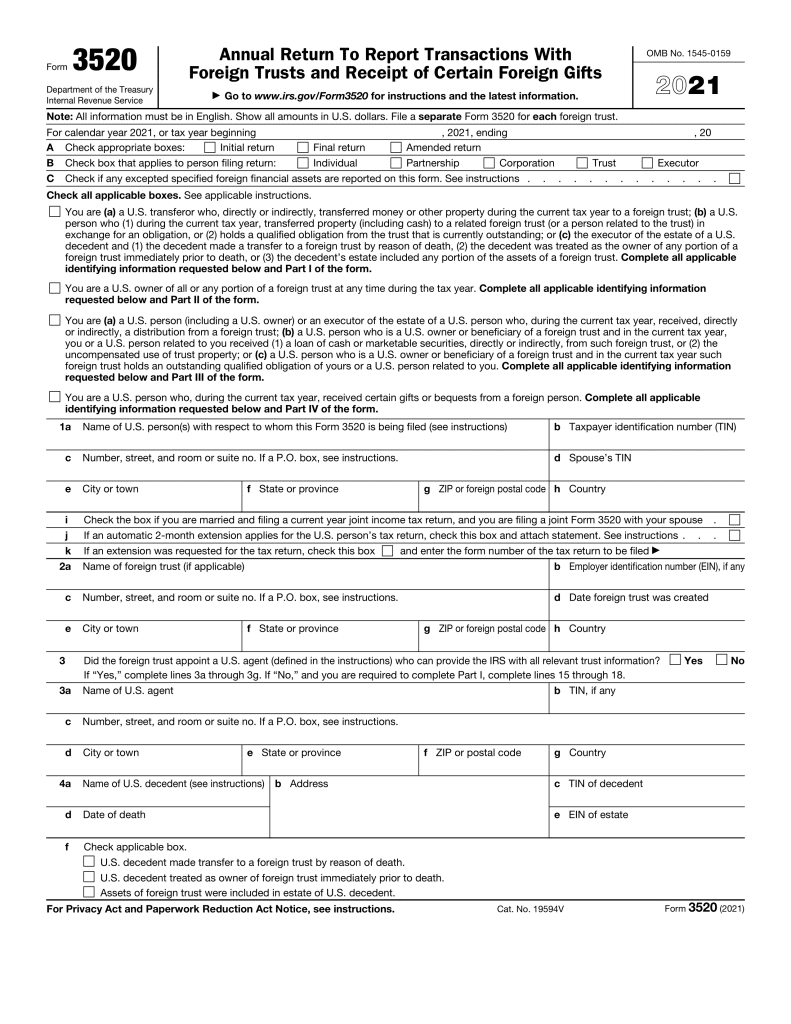

Form 3520 Reporting Foreign Trusts And Gifts For Us Citizens

Person receives from that nonresident alien individual or foreign.

. Professionally licensed by the state and our. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US. The gift tax rates start at 18 and increase to a maximum rate of 40.

This also means that you could be subject to tax penalties for failing to report the gift even though you did not have to report it as income. Citizen or resident is required to report a foreign gift that exceeds 16076 adjusted annually for inflation during the year if the gift is from a foreign corporation or. Ad A Tax Advisor Will Answer You Now.

Ad Make the World Your Marketplace w Aprios Intl Tax planning Services. Ad Exclusive Network of Top-Tier Freelance Accountants. Explore The Top 2 of Freelance Accountants Risk-Free Today.

Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. Our expertise ranges from basic tax management and. CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are addressed.

Transaction Advisory Services For International Mergers And Acquisitions. Form 3520 and 3520-A. Fortunately our CPA for US.

Taxable gifts reduce the donors 11700000 2021 lifetime gift and estate tax exclusion. If you own a foreign trust and you are a US person you need to file Form 3520-A annually. Foreign Trust and Foreign Gift.

Vetted Trusted by US Companies. In the following situations you need to file a. Citizen and you received 100000 or more from a nonresident alien individual or foreign estate that.

Gary Mehta CPA EA - A Delaware Accounting Firm. Juan Pablo Vasquez CPA is a Director at JPV Tax Services Wilmington office where he focuses on Tax Preparation and BusinessIndividual Consultation. The penalty for failing to file Form 3520 is 5 of the value of the gift per month not to exceed 25 for each person who received a gift with a minimum fine of 10000.

Taxable gifts are added to the. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than. Ad Find Recommended Hockessin Tax Accountants Fast Free on Bark.

Where he prepared Tax. If the donor of the gifts is a nonresident alien individual or foreign estate and the aggregate value of the gifts that the US. Centrally located in Delaware we understand the local laws.

We Help 10000 People Everyday. 1000 N West St 1200 Wilmington DE 19801. To make an appointment.

Person other than an organization described in section 501 c and exempt from tax under section 501 a of the Internal Revenue Code who received large gifts or bequests. Gift tax is paid once the exclusion is exhausted. You can be subject to a penalty equal to 5 but not to exceed 25 of the amount of the foreign gift or bequest if youre required to file Form 3520 but fail to do so.

Ad Make the World Your Marketplace w Aprios Intl Tax planning Services. Transaction Advisory Services For International Mergers And Acquisitions. Top Reasons why you should hire a licensed accounting firm to form your business.

If the gift is from a nonresident alien or a foreign estate reporting is only required if the total amount of gifts from the nonresident alien or foreign estate is more than 100000. For years Papaleo Rosen Chelf PA has been providing quality personalized financial guidance to local individuals and businesses.

International Tax Cpas Louisiana New Orleans La

The Gift Tax Turbotax Tax Tips Videos

Form 3520 Reporting Foreign Trusts And Gifts For Us Citizens

How To Report A Foreign Gift Or Inheritance Of More Than 100k Youtube

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Gifts To U S Persons Marcum Llp Accountants And Advisors

Our Services For International Taxes Accounting

International Tax Preparation Bay Area Cpas Consultants

The Gift Tax Made Simple Turbotax Tax Tips Videos

Foreign Gift Taxes What You Need To Report

The Many Faces Of Form 3520 The Cpa Journal

Foreign National Investors Freedomtax Accounting Payroll Tax Services

U S Estate And Gift Tax Singerlewak

Nonresidents Think You Are Safe From U S Gift And Estate Taxes Think Again The Wolf Group

Valdescpa Us And International Tax Advisors

Kirkland Wa Cpa Firm International Tax Services Page Mary H Hawkins Cpa Ps

International Tax Attorney Cpa Foreign Tax Advisor

Taxes For Expats Our Tax Preparation Fees Price Cost

![]()

2022 International Tax Update Individual And Estate Tax Western Cpe